Candy Company Chapter 11 Bankruptcy Stuns Fans During Halloween Week

Table of Contents

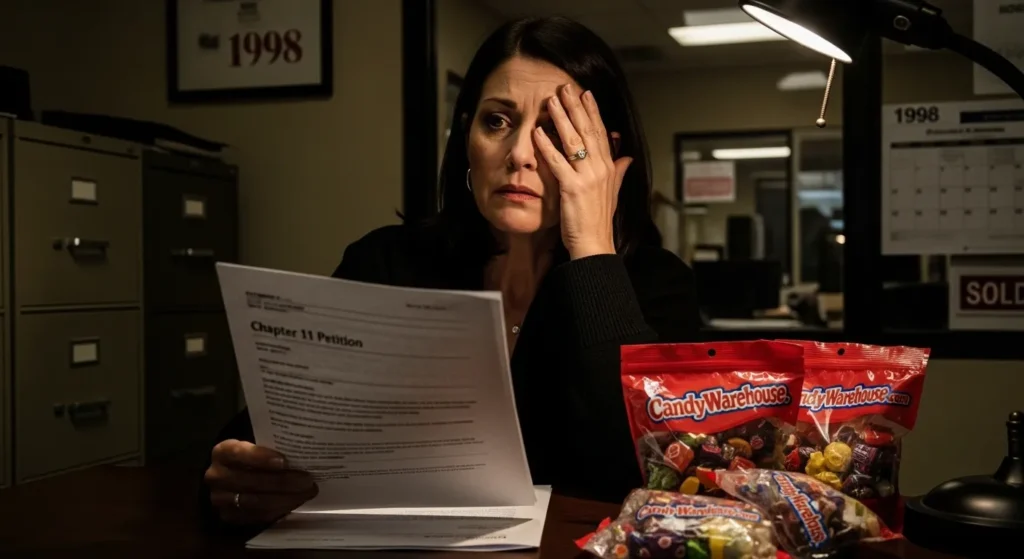

The timing could not have been worse for candy lovers across America. A well-known candy company chapter 11 filing has shocked consumers just days before Halloween. CandyWarehouse.com Inc. filed for bankruptcy protection on October 24, 2025, making headlines during the busiest season for sweet treats.

This candy company chapter 11 case has raised questions about the health of the confectionery industry. The bankruptcy filing comes as families prepare to spend billions on Halloween candy. The news has left many wondering what led this longtime business to seek court protection.

What Happened with the Candy Company Chapter 11 Filing

CandyWarehouse.com Inc. submitted its candy company chapter 11 petition to the U.S. Bankruptcy Court for the Northern District of Texas. The Sugar Land, Texas-based company listed assets between $100,000 and $1 million. However, liabilities ranged from $1 million to $10 million according to court documents.

The bankruptcy filing allows the company to continue operations while restructuring its debts. Attorney Robert Lane of The Lane Law Firm PLLC represents the company in this case. The court scheduled a hearing for October 29, 2025, to review requests for operating expense approvals.

The candy company chapter 11 case involves between 1 and 49 creditors. This woman-owned, minority family business has served customers since 1998. The company now faces the challenge of reorganizing its finances while maintaining customer trust.

Revenue Decline Led to Bankruptcy Protection

Financial data reveals why this candy company chapter 11 filing became necessary. The company generated approximately $4.5 million in online sales during 2024. This represented a 10% to 20% decrease compared to 2023 sales figures.

The situation worsened in 2025 as the bankruptcy filing approached. CandyWarehouse.com recorded $203,555 in revenue during August 2025 from 216,677 website visits. The company experienced a 20% revenue drop during May, June, and July compared to the previous three months.

Projections suggest the candy company chapter 11 case reflects deeper problems. Data firm Grips Intelligence predicted the company’s 2025 annual revenue would fall by 20% to 50%. The trend was expected to accelerate according to their analysis.

How This Bankruptcy Affects Halloween Shoppers

The candy company chapter 11 filing occurred during Halloween week when demand typically surges. Americans planned to spend $3.9 billion on Halloween candy this year. The bankruptcy filing raised concerns about product availability and order fulfillment.

CandyWarehouse.com maintained an inventory of over 6,000 candy varieties before the filing. The selection included name-brand chocolate bars, hard candies, lollipops, jelly beans, and gummy bears. The company also stocked Mexican candy, Japanese candy, cotton candy, and chewing gum.

The candy company chapter 11 case highlighted broader industry challenges. Candy prices increased 10.8% this Halloween season compared to last year. This rate nearly quadrupled the overall inflation rate. Chocolate specifically became 7.5% more expensive than the previous year.

The Company Behind the Bankruptcy Filing

CandyWarehouse.com stands out as a woman-owned, minority family business. The company has operated since 1998, building a reputation for fresh products and personal service. This candy company chapter 11 case puts that legacy at risk.

The business serves diverse customers including hotels, resorts, hospitals, and healthcare facilities. Zoos, theme parks, restaurants, cafes, and candy shops also relied on their inventory. Event planners and private individuals made up another significant customer segment.

The company prides itself on internal operations before the bankruptcy filing. CandyWarehouse.com never outsourced customer service or warehouse workers. Most team members stayed with the company for over 15 years. The firm guaranteed freshness with no closeout products or stale candy.

Why Candy Companies Face Financial Pressure

The candy company chapter 11 situation reflects wider industry struggles. Chocolate prices surged due to cocoa bean shortages and supply chain disruptions. Cocoa traded as high as $12,000 per ton, though prices improved slightly later.

Many consumers cut back on candy purchases as prices climbed. Approximately 60% of Americans live paycheck to paycheck according to reports. This financial strain leads people to reduce spending on non-essential items like candy.

The retail sector battled various economic challenges throughout 2025. Higher labor costs and product expenses driven by inflation hurt profit margins. Increased interest rates on debt added to the financial burden companies faced.

What Chapter 11 Bankruptcy Means for the Business

A candy company chapter 11 filing provides breathing room for reorganization. Chapter 11 allows companies to continue operating while developing a restructuring plan. The court supervises the process to protect creditor interests and preserve business value.

The bankruptcy protection enables CandyWarehouse.com to renegotiate debts and contracts. The company can seek approval for essential operating expenses during restructuring. This support helps maintain inventory, fulfill orders, and pay employees.

The goal of this candy company chapter 11 case involves emerging as a stronger business. The company aims to reorganize finances while preserving its brand and customer base. Success depends on developing a viable plan that satisfies creditors and the court.

Industry Trends That Contributed to Bankruptcy

The candy company chapter 11 filing occurred amid significant market shifts. Non-chocolate candy gained market share as chocolate became more expensive. Gummy candy dollar sales increased 8.5% year-over-year, while jelly beans jumped 17.4%.

Online candy sales faced particular challenges leading to this bankruptcy situation. While e-commerce grew in some sectors, CandyWarehouse.com struggled to maintain revenue. Competition intensified from both online retailers and brick-and-mortar stores.

The timing of seasonal sales became crucial for candy businesses. Companies increasingly depended on holidays for revenue growth as routine purchases declined. This candy company chapter 11 case demonstrates the risk of relying on concentrated sales periods.

Comparing Candy Industry Bankruptcy Cases

This candy company chapter 11 filing follows other notable retail bankruptcies in 2025. Several wedding venues, home décor chains, and specialty retailers sought court protection. High-end candy brand Sugarfina previously filed for bankruptcy as well.

The bankruptcy wave reflects changing consumer behavior and economic pressures. Rising costs, debt burdens, and shifting shopping patterns challenged traditional business models. Many companies lacked the financial cushion to weather these storms.

CandyWarehouse.com’s candy company chapter 11 case shares common themes with other filings. Revenue declines, mounting debt, and operational challenges preceded court protection. The outcome will influence how similar businesses approach restructuring.

What Customers Should Know About the Filing

The candy company chapter 11 protection aims to keep the business running during restructuring. Customers can expect continued operations while the court process unfolds. The company seeks to honor existing commitments and maintain service levels.

Questions about orders and refunds naturally arise after a bankruptcy announcement. Customers with pending orders should monitor communication from the company. The restructuring plan will address how to handle outstanding customer obligations.

The candy company chapter 11 outcome remains uncertain for now. The company could successfully reorganize and emerge from bankruptcy stronger. Alternatively, it might sell assets to a buyer or face liquidation if restructuring fails.

The Future of CandyWarehouse.com After Bankruptcy

This candy company chapter 11 case will determine the business’s survival. The restructuring process typically takes several months to complete. Court approval of a reorganization plan marks the path forward.

The bankruptcy filing provides an opportunity to reset the business model. Management can renegotiate supplier contracts, adjust inventory levels, and streamline operations. These changes could position the company for long-term success.

Industry observers will watch this candy company chapter 11 case closely. The outcome may signal broader trends in online candy retail. Other companies facing similar challenges might learn from CandyWarehouse.com’s experience. Click here to read more about Amazon Layoffs: Company Reportedly Plans 30,000 Corporate Job Cuts.

Lessons from This Candy Company Bankruptcy

The candy company chapter 11 filing offers important business lessons. Even established companies with loyal customers face financial pressure. Revenue declines can quickly spiral when fixed costs remain high.

The bankruptcy situation highlights the importance of financial flexibility. Companies need reserves to weather economic downturns and market shifts. Debt levels must remain manageable relative to revenue and cash flow.

This candy company chapter 11 case emphasizes the value of adaptation. Businesses must respond to changing consumer preferences and market conditions. Those that fail to evolve risk falling behind competitors.

Final Thoughts

The candy company chapter 11 filing by CandyWarehouse.com shocked the industry during Halloween week. This bankruptcy case reflects broader challenges facing retail businesses in 2025. Rising costs, changing consumer behavior, and intense competition created perfect storm conditions.

The woman-owned, minority family business seeks to reorganize and continue serving customers. Whether this candy company chapter 11 protection leads to recovery or closure remains to be seen. The court process will determine the fate of this 27-year-old company.

Consumers and industry stakeholders await the outcome of this bankruptcy case with interest. The decision will impact employees, suppliers, customers, and creditors. This candy company chapter 11 filing serves as a reminder that no business is immune to financial distress when market conditions deteriorate.