PLTR Stock Q4 Earnings Forecast: Palantir Beats Estimates but Valuation Worries Weigh on Shares

Table of Contents

Palantir Technologies has become one of the most talked‑about stocks of 2025. PLTR Stock has surged this year as investors bet that the company’s artificial‑intelligence tools will reshape data analysis. We examine Palantir’s latest results, its raised Q4 guidance and why valuation worries remain. Our focus keyword appears throughout this piece to keep the article tightly aligned with search intent.

PLTR Stock Q3 Results and New Q4 Outlook

Palantir’s third‑quarter report set a high bar. The company posted revenue of $1.18 billion, beating analysts’ estimate of $1.09 billion and growing about 63 % year‑over‑year. Adjusted earnings per share came in at $0.21, ahead of expectations for $0.17. Palantir’s U.S. revenue rose 77 %, U.S. commercial revenue surged 121 %, and government revenue grew 52 %. The company also closed 204 deals worth at least $1 million and reported a record $2.76 billion in total contract value. These figures underscore strong momentum in both its commercial and government segments.

The company used its strong quarter to lift forward guidance. In its official release, management said they expect fourth‑quarter revenue of between $1.327 billion and $1.331 billion. Adjusted income from operations is projected at $695 million to $699 million. Palantir also raised its full‑year revenue forecast to $4.396 billion–$4.400 billion and increased expectations for U.S. commercial revenue to at least $1.433 billion. These upward revisions signal confidence that the demand boom in artificial‑intelligence software will continue into Q4. Unsurprisingly, PLTR Stock jumped immediately after the announcement before sliding on valuation worries.

AI‑Driven Business Momentum

Palantir credits its Artificial Intelligence Platform (AIP) for compounding client value across government and corporate sectors. In Q3, the firm’s U.S. commercial revenue more than doubled, driving overall U.S. growth of 77 %. CEO Alex Karp said Palantir’s Rule of 40 score reached 114 %, far above the 40 % benchmark. This score combines revenue growth and profitability, illustrating how the business maintains high margins while expanding quickly. Operating margins were 33 % GAAP and 51 % adjusted. Free cash flow topped half a billion dollars. Such results support the view that Palantir’s platform is winning large contracts and scaling efficiently.

In addition, the company closed 53 deals over $10 million and reported that total contract value rose 151 % to nearly $3 billion. Wedbush analyst Dan Ives described the quarter as “another validation moment for AI demand” and called Palantir the “Messi of AI”. Partners like Snowflake, Lumen and Nvidia have also been announced, illustrating that Palantir is building a broad ecosystem around its platform. This momentum helps explain why investors have driven PLTR Stock to record highs. Click here to read more about AMD Q3 Earnings Report: Wall Street Awaits Update After Major AI Chip Wins.

Market Reaction and Valuation Concerns

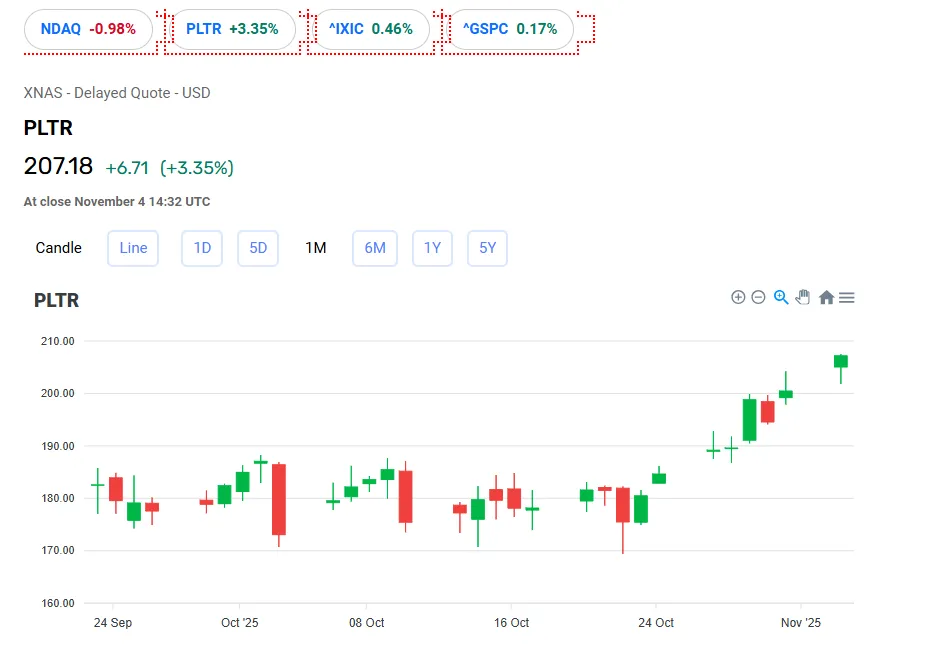

Despite the strong numbers, Palantir’s share price has been volatile. After the earnings release, PLTR Stock fell over 4 % in pre‑market trading. The share price stood around $207, the stock’s 52‑week high, but analysts’ average price target was about $156. The Reddit community r/stocks noted that Palantir expects Q4 revenue of $1.33 billion, well above the $1.19 billion analysts expected, yet the stock pulled back because many investors worry about lofty valuations. Over the past year, the stock has surged more than 170 %, pushing the company’s market capitalization past $490 billion. This places Palantir among the most valuable technology names, even though its revenue base is still small compared to other giants.

Valuation multiples highlight the concern. According to market‑analysis site Equiti, Palantir’s price‑to‑earnings ratio stood at about 453× and its price‑to‑book ratio around 54×. These metrics are far above sector averages and imply that the stock is priced for near‑perfection. Analysts caution that if growth slows or costs rise, the high multiples could compress sharply. The company’s year‑to‑date share performance of +163 % further illustrates how much optimism is baked into the price. Markets often re‑evaluate such optimism when interest rates are high and global growth uncertain.

The TIKR article also emphasized that net income more than tripled to $475.6 million and revenue has now topped $1 billion for two straight quarters. However, the site warns that PLTR Stock trades at an extreme multiple compared with other tech giants. Retail investors have helped push the stock to new heights, but some analysts question whether the current price is sustainable. These valuation fears were echoed on social media, where commentators highlighted that Palantir’s market capitalization is similar to more diversified firms yet its revenue base remains smaller.

Government and Commercial Segments

Palantir’s results show balanced growth across its core segments. Government revenue increased 52 % to $486 million as the company continues to secure contracts with agencies like the U.S. Army. The government business has long been Palantir’s backbone and provides stable, recurring revenue. However, it is the commercial segment that now drives most of the excitement. Commercial revenue more than doubled to $397 million as organizations adopt the AIP platform to enhance decision‑making. Palantir also reported that total contract value for commercial deals increased more than fourfold to $1.31 billion. This diversification helps support long‑term growth and makes the elevated guidance appear achievable.

The combination of government and commercial momentum underscores the central message: Palantir’s AI software is finding widespread acceptance. Yet investors remain wary because it is unclear whether this growth will persist at the same pace. A slowdown in public‑sector budgets or a shift in corporate spending could cause the revenue base to decelerate. Such uncertainties often spark volatility in PLTR Stock when valuations are high.

Social Media Sentiment and Investor Debate

On social forums like Reddit, the conversation around Palantir is intense. In the r/stocks thread “Palantir tops estimates, boosts fourth‑quarter guidance on AI adoption,” users highlighted that earnings per share of $0.21 beat expectations and revenues of $1.18 billion surpassed analyst estimates. The post also noted that Palantir expects $1.33 billion of revenue in Q4. Commenters praised the growth of the commercial business and the $10 billion U.S. Army contract. However, others warned that the stock trades at extreme multiples and speculated that a modest earnings miss could trigger a pullback. Some pointed to CEO Alex Karp’s response to detractors, where he argued that the company allows retail investors to achieve returns “previously limited to the most successful venture capitalists”. These discussions illustrate how polarizing PLTR Stock has become.

While direct access to posts on X is restricted, the same themes appear in news coverage of social media. Numerous outlets reported that posts on X celebrated Palantir’s revenue beat and AI‑driven momentum while also questioning the stock’s lofty price. The overall sentiment can be summarized as cautiously optimistic: many believe Palantir’s technology positions it at the heart of the AI revolution, but there is widespread recognition that the valuation leaves little room for error.

Analyst Views and Price Targets

Analysts remain divided on PLTR Stock. Wedbush’s Dan Ives reiterated his Outperform rating and a $230 price target, citing Palantir’s leadership in AI and calling it the “Messi of AI”. However, other firms are more cautious. Equiti notes that the average analyst price target is around $154.79, well below the current share price. On TIKR, the pre‑market reaction after the earnings release shows that some investors took profits despite the strong numbers. This divergence in views reflects a fundamental tension: the company’s operational performance is impressive, but its valuation metrics are stretched.

Goldman Sachs has reportedly raised its target on Palantir due to AI growth, yet the bank simultaneously flagged potential risks. Similarly, research firm Morningstar emphasizes that while revenue growth is extraordinary, the company must demonstrate that it can sustain margins over time. Because PLTR Stock is priced for perfection, any signs of slowing sales or rising costs could lead to rapid multiple compression. Investors therefore must weigh the upside of AI adoption against the downside of valuation re‑rating.

Risks and Opportunities Ahead

Looking forward, Palantir faces both catalysts and challenges. On the positive side, the company’s AIP platform has barely scratched the surface of its potential market. Corporations across industries are looking to integrate AI into supply chains, health care, finance and more. Palantir’s ability to close 53 deals above $10 million suggests that large enterprises trust its software. The government segment also offers a long pipeline of contracts, especially as national security agencies increase their data‑analysis spending.

On the risk side, macroeconomic conditions could weigh on corporate IT budgets. Rising interest rates and the possibility of an economic slowdown might cause clients to delay new projects. Geopolitical tensions and regulatory scrutiny, particularly around data privacy, may also pose headwinds. If any of these factors temper growth, the market’s willingness to assign a high valuation to PLTR Stock could wane. Investors should monitor contract wins, customer churn and margin trends in upcoming quarters.

Final Thoughts on PLTR Stock

Palantir delivered a blow‑out third quarter and raised guidance for the final quarter of 2025. Revenue growth of 63 %, rising margins and record contract wins highlight robust demand for its AI platform. The company expects Q4 revenue around $1.33 billion and has lifted its full‑year outlook. Our analysis shows that Palantir’s commercial and government businesses are both accelerating. Social media buzz, particularly on Reddit, reflects both excitement and concern: investors applaud the company’s success but question whether the lofty valuation is justified.

PLTR Stock remains a polarizing investment. We believe the company is well positioned to benefit from the AI revolution, yet the stock’s extreme multiples make it sensitive to any slowdown. Conservative investors may prefer to watch for a more attractive entry point. Those willing to accept volatility might view declines as buying opportunities, provided they maintain a long‑term perspective. In any case, Palantir’s upcoming Q4 report will be closely watched to see whether the company can once again beat expectations and support its hefty market capitalization.