Lenskart Recovers After Weak Debut, Ends First Trading Day Above IPO Price

Table of Contents

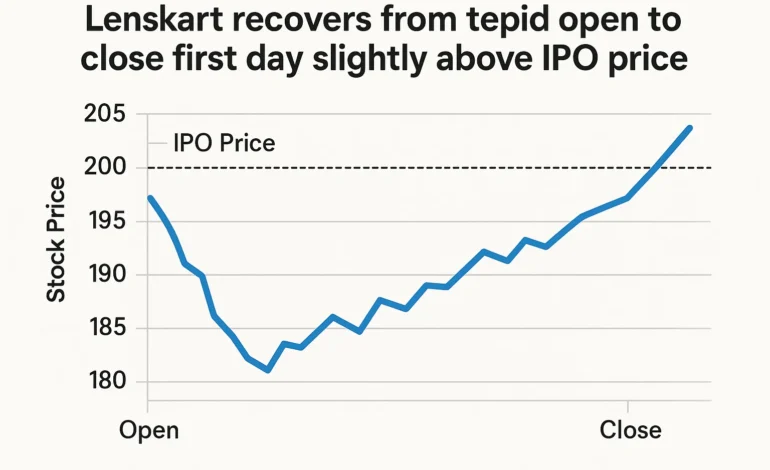

Lenskart Solutions made a dramatic intraday comeback on its first trading day. The eyewear retailer opened at ₹395 on the NSE—1.7% below its ₹402 IPO price—then plummeted to ₹356.10 before rallying to close at ₹404.55. This recovery, while positive on paper, masks a heated debate about whether the company’s ₹702 billion ($8 billion) valuation justifies the investment. The 28-times oversubscribed IPO raised ₹72.8 billion ($821 million), yet institutional hesitation on day one revealed cracks in market confidence.

The Valuation Question That Won’t Go Away

Lenskart’s valuation sparked immediate controversy. The company commanded a price-to-earnings ratio of 238x—meaning investors pay ₹238 for every rupee earned. Ambit Capital issued a “sell” rating just days before listing, setting a target price of ₹337, implying 16% downside from the IPO price. This aggressive stance reflected a broader concern: Lenskart’s market-implied valuation far exceeded capital-efficient peers like Nykaa, Trent, and Titan’s eyewear business.

The numbers tell why analysts grew skeptical. In fiscal year 2025, Lenskart posted ₹2.97 billion in net profit, but ₹1.67 billion came from a one-time accounting gain tied to its Owndays acquisition. Stripping that out, core profit stood at just ₹1.30 billion ($15 million). CEO Peyush Bansal defended the pricing, telling the media the IPO was “fairly priced” based on institutional feedback. Yet founder exits told a different story—Bansal himself sold shares valued at ₹804 crore, booking a 21x return on his original investment.

Business Fundamentals Remain Strong Despite Market Skepticism

Revenue growth offers a compelling counterpoint to valuation concerns. Lenskart’s top line surged 23% year-over-year to ₹66.53 billion in FY25. EBITDA jumped nearly fourfold to ₹971 crore, while operating cash flow shot up 13 times to ₹1,231 crore. The company achieved profitability after recording losses in prior years—a milestone venture-backed retailers rarely reach before going public.

Lenskart’s vertically integrated model—controlling everything from manufacturing to retail—differentiates it from legacy optical chains and direct-to-consumer rivals. The company operates across price points, competing with Titan Eye+ and emerging players while maintaining market leadership in India’s organized eyewear sector. Yet scale remains unproven; the company must demonstrate it can expand profitably both domestically and internationally while defending its market share.

Looking ahead, Lenskart plans to open new stores, strengthen supply chains, and invest in technology and marketing using IPO proceeds. However, capital-intensive retail expansion will weigh on free cash flow through FY28, a concern for value-focused investors scrutinizing return ratios.

Market Sentiment Shifts From Hype to Caution

Social media revealed the widening gap between IPO narrative and investor reality. On Reddit’s IndianStreetBets forum, traders debated whether Lenskart would “burst the entire IPO bubble,” citing parallels to the PayTM disaster. The grey market premium crashed to ₹10 before listing—a sharp decline from earlier projections of ₹16-17—signaling cooling excitement among unofficial traders.

DSP Asset Managers, which invested in Lenskart ahead of the listing, defended the deal while conceding it was “expensive,” calling the business “strong and scalable.” This nuanced stance captured institutional ambivalence: Lenskart’s fundamentals deserve respect, but the price demanded a leap of faith.

Retail investors showed markedly less enthusiasm than institutions. While the QIB portion received 40.36x demand, retail bidding was subscribed just 7.56x—a 5-fold difference revealing retail skepticism about valuations. Independent analyst Ambareesh Baliga told Reuters that “Lenskart looks good from a business model perspective, but at the right valuation which is much lower than the current levels,” emphasizing that weak debuts despite strong subscription could dampen enthusiasm for future IPOs. Don’t miss our recent post about Bessent Says Trump’s $2,000 ‘Dividend’ Could Arrive Through Tax Cuts.

What Happens Next: The Real Test Begins

Lenskart’s recovery to ₹404.55—above the IPO price—offers a technical victory but not strategic vindication. The stock touched an intraday high of ₹413.80 (up 2.98% from IPO price) and low of ₹355.70 (down 13.02%), showcasing extreme volatility. This trading pattern reflects genuine uncertainty: long-term investors betting on execution versus traders booking quick losses.

The company faces a critical proving period over the next 2-3 quarters. Can it sustain the 23% revenue growth while maintaining profitability? Will capital expenditure crush free cash flow, or will operational leverage kick in as stores scale? Investors who saw the grey market premium collapse and intraday plunge should closely monitor quarterly results, competitive dynamics, and the company’s ability to expand internationally beyond India’s eyewear market.

For investors evaluating entry points, Ambit Capital’s sell rating and the weak debut signal patience may pay dividends. The market has spoken: brand strength and growth potential exist, but current valuations price in near-perfect execution. Any stumble in expansion, profitability, or competitive positioning could trigger further downside—a lesson reinforced by Lenskart’s volatile first day.

Citations:

- TechCrunch – Lenskart recovers from tepid open to close first day slightly above IPO price, November 10, 2025

- Hindustan Times – Lenskart share price settles 0.32% higher than IPO price, November 10, 2025

- Inc42 – Lenskart IPO: Peyush Bansal Rakes In INR 804 Cr, November 9, 2025

- Menafn – Lenskart’s Stock Market Debut Falls Flat: What Should Investors Do Now?, November 9, 2025

- Reddit – Lenskart is going to burst the entire IPO bubble, IndianStreetBets, November 6, 2025

- Moneycontrol – Lenskart IPO: Only major public issue this year to list at loss, November 9, 2025