AMD Q3 Earnings Report: Wall Street Awaits Update After Major AI Chip Wins

Table of Contents

Advanced Micro Devices (AMD) is preparing to report its third-quarter 2025 earnings after the market closes on November 4, 2025, following a transformative period that has reshaped the company’s position in the artificial intelligence infrastructure market.

The AI Chip Momentum Behind AMD’s Remarkable Stock Surge

AMD’s stock has experienced an extraordinary run, gaining 58 percent in October alone—the company’s best monthly performance since January 2001. The surge has pushed AMD’s market capitalization beyond $400 billion for the first time, positioning it as a major player challenging Nvidia’s dominance in AI accelerators.

This dramatic ascent stems primarily from two landmark partnerships announced in early October: a multi-year deal with OpenAI to deploy 6 gigawatts of AMD graphics processing units and a complementary agreement with Oracle to deploy 50,000 of AMD’s next-generation MI450 Instinct GPUs starting in the second half of 2026.

What Wall Street Expects for Q3 Earnings

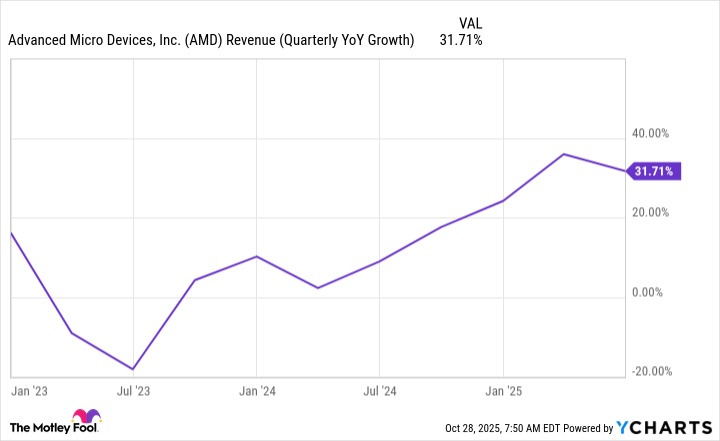

Consensus analyst estimates project AMD will report Q3 2025 revenues of approximately $8.7 billion, representing roughly 28 percent year-over-year growth, while adjusted earnings per share are expected to reach $1.17, indicating 27.2 percent year-over-year growth. These estimates suggest the company’s data center segment will contribute $4.1 to $4.18 billion in revenue, up approximately 17 percent to 17.7 percent compared to the same quarter last year.

The data center business has become AMD’s primary growth engine, driven by strong adoption of its EPYC server processors and the ramping of its Instinct MI350 series accelerators. Beyond the data center, Wall Street expects robust performance from AMD’s client segment, which includes CPU sales for laptops and desktops, projected to generate $2.6 billion in revenue—a remarkable 38 percent year-over-year increase. The gaming segment is anticipated to deliver $1.1 billion in revenue, representing exceptional 139 percent year-over-year growth.

The Strategic Importance of the OpenAI and Oracle Deals

The OpenAI partnership represents a watershed moment for AMD in its competitive battle against Nvidia, which currently holds an estimated 90 to 94 percent share of the data center GPU market. Under the agreement, OpenAI will deploy AMD’s MI450 and future-generation Instinct GPUs to power 6 gigawatts of computing capacity, with an initial 1-gigawatt rollout scheduled for the second half of 2026. AMD’s Chief Financial Officer Jean Hu stated the partnership is expected to deliver tens of billions of dollars in revenue for AMD while being highly accretive to the company’s non-GAAP earnings per share.

The simultaneous Oracle agreement further validates market appetite for AMD’s AI infrastructure solutions. Oracle Cloud Infrastructure will deploy 50,000 MI450 Instinct GPUs, also beginning in the second half of 2026, establishing AMD as a credible alternative to Nvidia across major cloud infrastructure providers. Analysts at Wedbush estimate that each gigawatt of AI capacity could translate to approximately $20 billion in AMD sales over time, underscoring the massive revenue potential these deals represent.

AMD’s AI Chip Technology Compared to Competitive Offerings

AMD’s Instinct MI350 Series GPUs represent a significant technological achievement in the AI acceleration market. These processors feature 288GB of HBM3E memory with 8TB/s peak theoretical memory bandwidth, delivering up to 4 times the peak theoretical AI performance compared to competitive accelerators. The MI350 Series is built on the cutting-edge 4th Generation AMD CDNA architecture and fabricated using TSMC’s advanced 3-nanometer process, offering substantial memory capacity advantages over comparable Nvidia solutions.

The MI350 delivers compelling real-world performance improvements for AI workloads, offering up to 4.2 times better performance in AI agent and chatbot applications, up to 2.9 times better performance in content generation tasks, and up to 3.8 times better performance in additional computing scenarios. These specifications position the MI350 as particularly well-suited for large-scale AI model training and inference operations, where memory bandwidth and capacity constraints often limit performance.

The Timing Question: When Does Revenue Impact Begin?

A critical consideration for investors is that analysts do not expect substantial financial impact from these major deals to materialize in the Q3 earnings report. Both OpenAI and Oracle will not begin utilizing AMD’s MI450 series Instinct GPUs until the second half of 2026. This means Q3 2025 results will primarily reflect AMD’s existing product portfolio, particularly strong EPYC processor sales and the gradual ramping of the MI350 series, which entered production earlier in 2025.

UBS Global Research analyst Timothy Arcuri noted that many customers appear to be adopting a wait-and-see approach, with some hesitating on MI355x purchases while waiting for MI450 rack-scale solutions in 2026. This dynamic suggests that near-term financial upside from the landmark AI partnerships may be limited, with the real inflection point arriving in 2026 and 2027 when large-scale MI450 deployments commence.

AMD’s Data Center and Market Share Momentum

Beyond AI accelerators, AMD’s data center CPU business continues demonstrating robust momentum. The company’s EPYC processor line has achieved record market share gains, capturing approximately 41 percent of server CPU revenue in the second quarter of 2025, up from 33.8 percent in the same period last year. This represents a 7.2 percent year-over-year increase in revenue share, indicating AMD’s successful penetration of the high-end server market where margins are strongest.

AMD’s EPYC server CPU unit share reached 27.3 percent in Q2 2025, representing 3.6 percent year-over-year growth driven by the latest EPYC platform ramp and expanding adoption among cloud hyperscalers including Google, Oracle, Amazon, and others. More than 100 new AMD-powered cloud instances launched during Q2 2025, bringing the total to approximately 1,200 EPYC cloud instances available globally. This broad ecosystem expansion demonstrates enterprises’ growing confidence in AMD’s server platform as a cost-effective alternative to Intel’s increasingly challenged Xeon lineup.

Analyst Expectations and Key Watch Points

Morgan Stanley analyst Joseph Moore maintained his Equal weight rating and $246 price target heading into earnings, noting that AMD should post a very strong data center quarter given robust server demand and Intel’s supply constraints. However, Moore expressed caution about near-term GPU demand, stating that demand for AMD’s graphics processing units looks merely “fine” as of the earnings date, with expectations for more selective GPU purchasing going forward.

Bank of America and several other major investment firms raised their 12-month AMD price targets into the $250 to $310 range following the OpenAI announcement, reflecting confidence in the company’s long-term positioning. Morgan Stanley raised its 2027 revenue forecast for AMD to $51.2 billion from $44.2 billion, demonstrating analyst belief in the company’s ability to capture meaningful share in the rapidly expanding AI infrastructure market.

Key Performance Metrics Wall Street Will Scrutinize

Investors will closely examine AMD’s Q3 gross margin, which the company has guided to approximately 54 percent on a non-GAAP basis, recovering from earlier challenges related to U.S. export controls and inventory adjustments. The company’s operating margin progression will also receive scrutiny, as it demonstrates AMD’s ability to convert increased revenue scale into profitability. Additionally, management commentary regarding demand trends for the MI350 series and guidance for future quarters will provide critical insight into whether AMD can sustain momentum as it transitions toward MI450 deployments in 2026.

The Valuation and Execution Risk Equation

While AMD’s stock has performed exceptionally well, reaching near-record highs above $260 per share, analysts acknowledge that much of the upside already reflects these growth expectations. UBS analyst Timothy Arcuri noted that AMD’s recent outperformance presents a “challenged” setup for the stock heading into earnings, suggesting that execution must be flawless to justify current valuations. Any disappointment on margins, guidance, or pipeline visibility could trigger a meaningful pullback toward the $230 to $240 support zone, according to technical analyst assessments.

Looking Ahead: The Critical Role of the Upcoming Analyst Day

AMD will host an analyst day on November 11, 2025, just one week following the Q3 earnings announcement. This event may provide more detailed commentary regarding the company’s long-term AI strategy, product roadmap, and competitive positioning versus Nvidia. Analysts anticipate that AMD may reserve significant strategic announcements for this venue rather than the quarterly earnings call, suggesting the investor presentation could deliver outsized market impact.

Conclusion

AMD’s Q3 2025 earnings report arrives at a pivotal moment for the semiconductor industry, occurring amid transformative partnerships with OpenAI and Oracle that have fundamentally altered investor perceptions of the company’s competitive positioning. While Q3 results will likely reflect solid performance in AMD’s core data center CPU and client business, the real inflection point for AI-driven revenue growth remains 2026 and beyond.

Wall Street will scrutinize margins, guidance, and management commentary for evidence that AMD can successfully execute its transition toward AI infrastructure dominance while managing near-term challenges including selective GPU demand and competitive pressures from Nvidia’s established market position. The combination of strong fundamentals, landmark partnerships, and reasonable valuation relative to long-term growth potential supports cautious optimism, though the stock’s recent extraordinary gains have already priced in substantial futureture success.