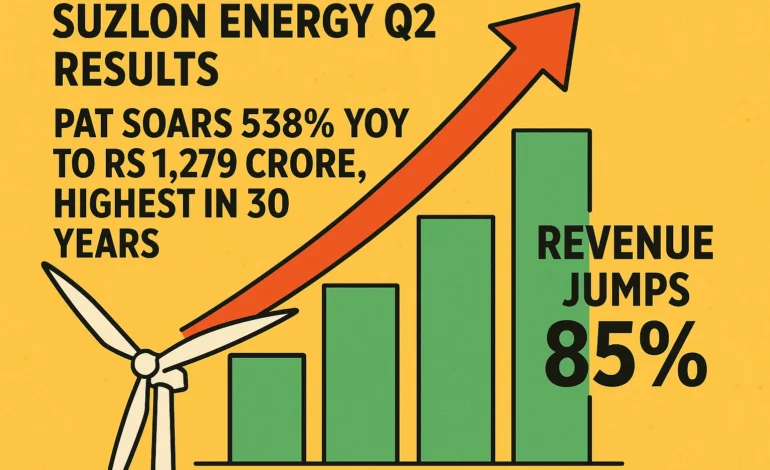

Suzlon Energy Q2 Results: Understanding the Record-Breaking Profit Surge

Table of Contents

Suzlon Energy delivered exceptional Q2 FY26 results, marking its strongest quarterly performance in three decades. The company reported a profit after tax (PAT) surge of 538% year-on-year to ₹1,279 crore, alongside revenue growth of 85% to ₹3,866 crore. These headline numbers reflect both operational excellence and a significant tax benefit, making this quarter a watershed moment for the renewable energy company.

Revenue Growth and Operational Performance

The company’s revenue expansion to ₹3,866 crore represents the highest quarterly revenue in Suzlon’s recent history. This 85% year-on-year increase from ₹2,093 crore in Q2 FY25 demonstrates robust execution across the organization’s core business segments. The revenue growth was primarily driven by record deliveries of wind turbine generators, showing strong demand for renewable energy solutions in India’s rapidly expanding wind power sector.

Operationally, Suzlon achieved its highest-ever Q2 India deliveries of 565 megawatts (MW), nearly tripling the 256 MW delivered in the same quarter last year. This 121% increase in deliveries reflects improved project execution capabilities and manufacturing efficiency. The first half of FY26 saw cumulative deliveries reach 1,009 MW, representing 90% growth compared to the first half of the previous year.

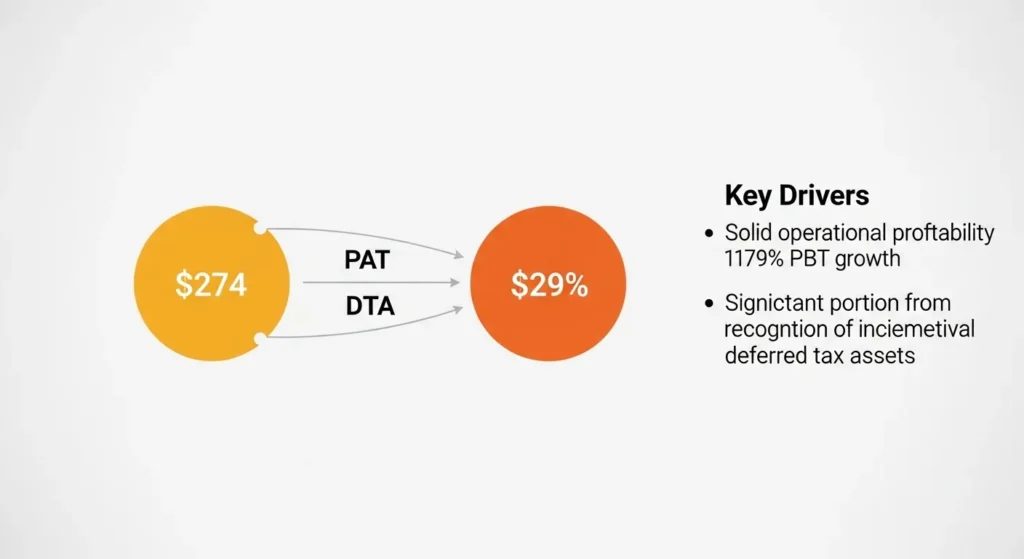

Understanding the Profit Surge

While the 538% PAT surge appears dramatic, it requires careful analysis to understand the underlying drivers. The company’s profit before tax grew 179% year-on-year to ₹562 crore, indicating solid operational profitability. However, a significant portion of the PAT increase came from the recognition of ₹717-718 crore in incremental deferred tax assets during the quarter.

Deferred tax assets represent tax credits that reduce future tax obligations. While this is an accounting benefit rather than operational profit, it reflects tax strategy optimization and provides genuine financial advantage to shareholders. The operating profit (EBITDA) grew 145% year-on-year to ₹721 crore, with EBITDA margins improving to 18.6%, up from 14.1% a year earlier.

Strong Order Book and Future Revenue Visibility

Suzlon’s order book crossed the 6 GW mark, reaching 6.2 GW as of September 30, 2025. The company secured over 2 GW in new orders during the first half of FY26. This substantial order book provides clear revenue visibility for upcoming quarters, with approximately 1.86 GW of deliveries expected in the second half of FY26.

The order composition is well-balanced and diversified. The order mix comprises 90% of the company’s S144 turbine models and 10% S120 models, with 80% being non-EPC contracts. The customer base spans 51% captive, commercial, and industrial clients; 34% government auction projects; and 14% public sector unit contracts. This diversification reduces dependence on any single customer segment or project type.

Financial Position and Balance Sheet Strength

Suzlon maintained a strong net cash position of ₹1,480 crore as of September 30, 2025. The company’s total assets reached ₹15,856 crore, while net worth increased to ₹7,860 crore from ₹6,106 crore in March 2025. These metrics demonstrate the company’s financial stability and capacity for growth investments.

The company’s debt-free status and positive cash position provide flexibility for capital expenditure, working capital management, and potential shareholder returns. During the quarter, Suzlon invested ₹298 crore in capital expenditure for manufacturing capacity expansion and operational infrastructure.

Market Context and Industry Tailwinds

India’s wind energy sector is experiencing significant growth tailwinds. The government has reduced GST on wind turbines from 12% to 5%, optimizing the levelized cost of energy (LCoE) and expanding wind penetration. India targets 122 GW of wind capacity by FY32, with wind power expected to dominate hybrid, round-the-clock, and firm dispatchable renewable energy projects.

The commercial and industrial sector alone is expected to require 100 GW of renewable energy capacity by 2030, presenting substantial growth opportunities for companies like Suzlon. Annual wind installations in India are expected to exceed 6 GW this year, indicating sustained demand momentum. Click here to read more about ATO Warning to Late Filers: File Your Tax Return Within 24 Hours or Face Fines.

Manufacturing Capacity and Competitive Position

Suzlon maintains India’s largest domestic wind manufacturing capacity at 4.5 GW, positioning the company as the leading wind turbine manufacturer in the country. The company emphasizes products designed and manufactured in India, aligning with government localization initiatives and addressing supply chain resilience concerns in the renewable energy sector.

Analyst Perspectives

Morgan Stanley maintained an “overweight” rating on Suzlon Energy with a price target of ₹77, implying potential upside of approximately 30% from the announcement levels. The brokerage highlighted that revenue, EBITDA, and adjusted profit exceeded its estimates by 29%, 31%, and 83% respectively, significantly beating street expectations.

Analysts noted that the company’s contribution margin reached 28% during the quarter, exceeding the estimated 24%, while EBIT margin stood at 14.8% against the expected 12%. These margin expansions indicate operating leverage and cost efficiency improvements across the business.

Suzlon Share Price Performance

Following the Q2 results announcement, Suzlon Energy’s stock price gained momentum, with the share trading higher in the days following the announcement. Over five years, the stock has delivered remarkable returns of approximately 1,963%, reflecting strong long-term value creation for shareholders.

Strategic Outlook and Future Prospects

The company’s consistent performance across revenue, EBITDA, and PAT over the last 11 quarters demonstrates disciplined execution and improving operational efficiency. Management highlighted focus on core business strengths, expanded manufacturing capacity, and the market opportunity from India’s renewable energy expansion targets.

With a strong order book providing revenue visibility, improving margins reflecting operational excellence, and favorable industry dynamics supporting demand growth, Suzlon appears well-positioned to capitalize on India’s renewable energy transition. The company’s financial strength, manufacturing capabilities, and diverse customer base provide a foundation for sustainable growth in the coming years.

The Q2 results mark a significant milestone for Suzlon Energy, reflecting the company’s successful navigation of India’s renewable energy opportunity and its emerging position as a leader in clean energy solutions.

Disclaimer:

The content shared by telavivdeclick is solely for research and informational purposes.