Wall St reacts sharply to Musk’s $1 trillion pay plan approval by Tesla investors

Table of Contents

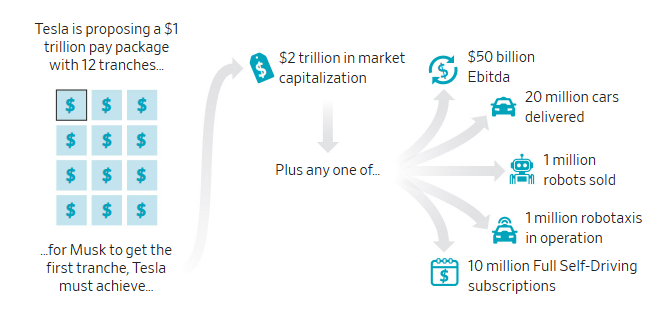

Today we’re diving into how Tesla, Inc. (TSLA) is making headlines after shareholders approved a $1 trillion pay package for long‐time CEO Elon Musk. This massive incentive plan, passed with over 75 % support at Tesla’s annual meeting in Austin, Texas, is fully contingent on the company hitting extraordinarily ambitious goals.

This move has triggered a strong reaction on Wall Street, raising questions about valuation, leadership focus and governance. For investors, it’s time to examine what this means for Tesla’s future, whether the targets are realistic and how the market is responding in real time.

The magnitude of the pay plan and what it requires

What Musk must deliver to unlock the pay

Tesla’s new compensation structure ties Musk’s potential payout to a series of aggressive milestones. According to filings:

- Executive compensation could exceed $1 trillion if all benchmarks are met.

- Key thresholds include achieving a market capitalization of $8.5 trillion over the coming decade.

- Operational targets require, among other items: delivering 20 million vehicles annually, deploying 1 million robotaxis, and producing 1 million humanoid robots (Optimus).

- Musk’s ownership and influence could rise to ~25 % of Tesla under the plan if fully vested.

Why Tesla pitched this package

Tesla’s board has stated the package is designed to retain Musk and align his incentives with shareholder value over a long horizon. The board argues that without a bold incentive, Musk may shift focus elsewhere, given his many ventures.

For investors, this shows Tesla is placing a huge bet on Musk’s vision and long-term growth rather than near-term stable earnings. The logic is that the payout only occurs if “extraordinary” results occur.

Market and investor sentiment reaction

Wall Street sentiment following the approval

With the shareholder vote concluded (over 75 % approval) this week, the market has exhibited mixed reactions. Some analysts view the approval as a green-light for Tesla’s bold strategy; others see significant risk.

For example:

- Analysts like Russ Mould (AJ Bell) see little downside for shareholders given the “pay only if milestones” structure.

- Conversely, Brian Dunn at Cornell questions whether Musk’s reward is grounded in current earnings or speculative value.

Current rating and valuation metrics

Looking at Tesla’s share metrics:

- Tesla’s share price recently closed at roughly US$444.26, with some sources showing ~US$455.51 in late Oct.

- Analyst consensus indicates a Hold rating with an average price target around US$390.27, implying a downside of around -14.5% from the current price.

For investors, this shows that while the excitement is high, the implied valuation is under pressure and many are cautious about near-term upside.

Implications for Tesla’s strategy and risks ahead

Strategic acceleration and long-term bets

The pay plan underscores Tesla’s push beyond EVs into software subscriptions (Full Self-Driving), robotaxis, energy storage and AI robotics. If Tesla hits its targets, the upside is enormous: sustained growth, dominant market share, and leadership in next-gen mobility. For investors, the reward for achieving these goals could be historic.

Key risks and investor considerations

However, the risks are significant:

- The goals are extremely aggressive and far out beyond Tesla’s current scale. Proxy adviser Institutional Shareholder Services (ISS) flagged the plan’s “astronomical grant value” and potential dilution risk.

- Execution risk looms large: Tesla must maintain Musk’s focus, scale manufacturing, navigate regulatory hurdles for autonomy and robots, and fend off increasing competition.

For investors, the takeaway is that Tesla is betting big — if the company misses major benchmarks, the payout might not be realized and the stock could be under pressure.

For more insights, check out Google to Announce Its Biggest-Ever Investment in Germany.

Investor reaction and market sentiment

Sentiment around Tesla is now a mix of optimism and caution. Some institutional players back the plan, seeing Musk as indispensable. Others oppose it on governance grounds.

For example, Norges Bank Investment Management, managing Norway’s sovereign wealth fund, publicly opposed the pay package, citing dilution and key-person risk.

On social media (X) and Reddit, some investors voiced excitement about Tesla’s long-term vision. On Reddit:

“If Tesla pulls off robotaxis and hits 20 m units a year, this payout is a bargain.”

Such sentiment suggests that many retail investors are willing to ride the long-term story, while institutional players are more measured. For investors, monitoring sentiment shifts and tracking progress toward milestones will be vital.

Bottom Line

In conclusion, Tesla’s $1 trillion pay deal for Elon Musk signals a bold wager on long-term growth and dominant industry disruption rather than short-term stability. We are witnessing a structural bet: if Tesla hits ambitious milestones, the payoff could be monumental for shareholders. However, the path is laden with execution risk, governance questions and valuation pressure.

For investors, the key takeaway is to maintain a balanced view — the upside is huge, but so is the risk. If you believe in Tesla’s transformative roadmap and Musk’s ability to deliver, this could be an opportunity. If not, the current price and expectations may make the risk-reward less compelling. Either way, stay attentive to Tesla’s quarterly updates, progress on robotaxis and subscriptions, and any shifts in investor sentiment.

FAQs

What exactly must Tesla deliver for Musk to earn the pay package?

Tesla must reach a market cap of ~$8.5 trillion and hit operational milestones including ~20 million vehicle deliveries annually, ~1 million robotaxis, and ~1 million humanoid robots over the next decade.

Will Musk earn the payout whether or not Tesla meets the targets?

No. The structure is performance-based: Musk receives nothing if the key tranches aren’t met. Tesla frames it as “he earns nothing unless we build unprecedented value”.

How are analysts rating Tesla stock right now?

Analysts currently lean cautious: consensus is a Hold rating for TSLA with an average price target near ~$390, implying potential downside from current levels.

What are the main risks for investors considering Tesla now?

Key risks include: Musk’s attention being divided among multiple ventures, Tesla failing to scale manufacturing or autonomous systems in time, dilution from the pay package, and near-term earnings pressure. Proxy advisers have flagged governance concerns.

What should investors watch next regarding Tesla?

Investors should monitor Tesla’s quarterly delivery numbers, revenue and margin trends, progress on subscriptions and robotaxi/robotics plans, any dilution announcements or board changes, and major statements by Musk or the board. Also, pay attention to how the market responds to milestones or misses — these will likely trigger sharp sentiment swings.